Accounting and bookkeeping services form the bedrock of any business's financial health. These services are important for maintaining accurate financial records, ensuring compliance with regulatory standards, and providing insights into the entire financial well-being of a company. By keeping meticulous track of all financial transactions, accounting and

Bookkeeping Services South Florida enable businesses to truly have a clear comprehension of their income, expenses, and profitability. In today's fast-paced and competitive business environment, where even small errors can result in significant financial repercussions, having professional accounting and bookkeeping services is more crucial than ever.

Accounting and bookkeeping services form the bedrock of any business's financial health. These services are crucial for maintaining accurate financial records, ensuring compliance with regulatory standards, and providing insights into the entire financial well-being of a company. By keeping meticulous monitoring of all financial transactions, accounting and bookkeeping enable businesses to really have a clear knowledge of their income, expenses, and profitability. In today's fast-paced and competitive business environment, where even small errors can result in significant financial repercussions, having professional accounting and bookkeeping services is more crucial than ever.

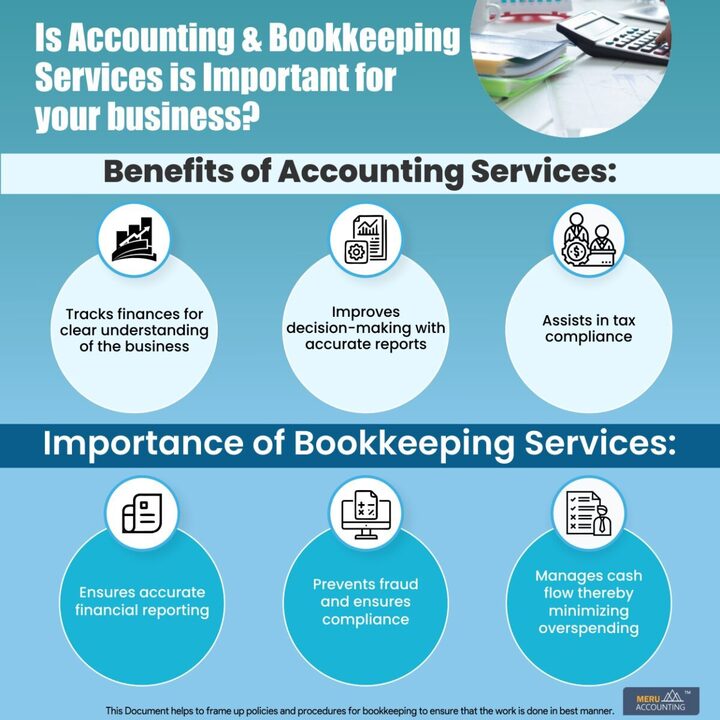

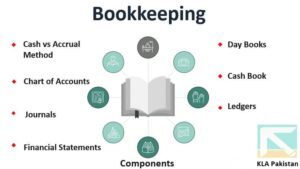

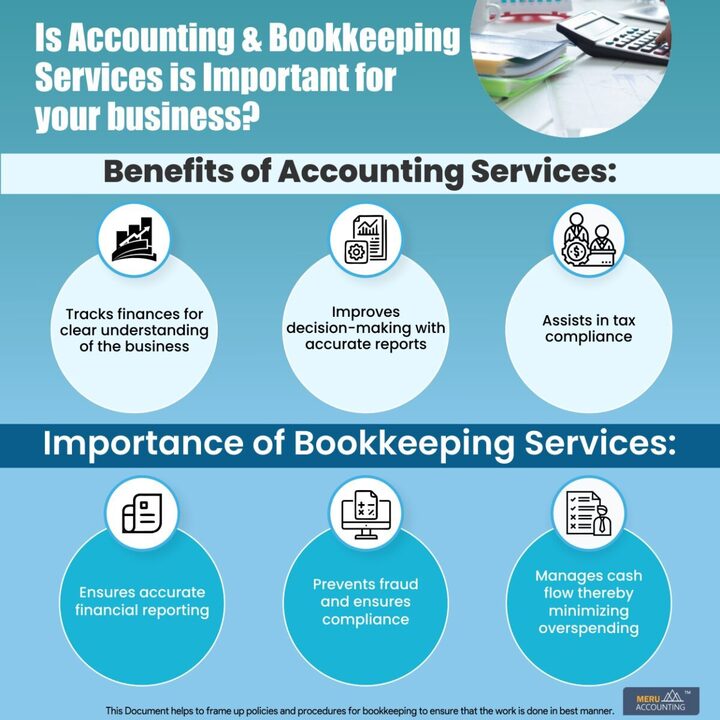

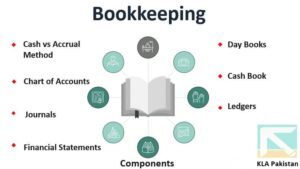

Bookkeeping, often considered the backbone of accounting, involves the systematic recording of financial transactions on a day-to-day basis. This process includes maintaining ledgers, reconciling bank statements, and tracking expenses, ensuring that each financial activity is documented in an organized and consistent manner. By maintaining an up-to-date and accurate group of books, businesses can monitor their cash flow, manage budgets, and make informed decisions. One of many biggest features of professional bookkeeping services is that they'll help businesses avoid costly mistakes, such as for instance underreporting revenue or overlooking deductible expenses during tax season.

Accounting and bookkeeping services form the bedrock of any business's financial health. These services are necessary for maintaining accurate financial records, ensuring compliance with regulatory standards, and providing insights into the general financial well-being of a company. By keeping meticulous monitoring of all financial transactions, accounting and bookkeeping enable businesses to truly have a clear comprehension of their income, expenses, and profitability. In today's fast-paced and competitive business environment, where even small errors can lead to significant financial repercussions, having professional accounting and bookkeeping services is more crucial than ever.

Bookkeeping, often considered the backbone of accounting, involves the systematic recording of financial transactions on a day-to-day basis. This process includes maintaining ledgers, reconciling bank statements, and tracking expenses, ensuring that every financial activity is documented in a organized and consistent manner. By maintaining an up-to-date and accurate pair of books, businesses can monitor their cash flow, manage budgets, and make informed decisions. Among the biggest benefits of professional bookkeeping services is they can help businesses avoid costly mistakes, such as for instance underreporting revenue or overlooking deductible expenses during tax season.

Accounting services rise above the essential recording of transactions; they involve the interpretation, classification, and analysis of financial data. Accountants prepare financial statements such as the balance sheet, income statement, and cash flow statement, which provide a comprehensive view of a company's financial health. These documents are vital for internal decision-making, in addition to for external stakeholders like investors, creditors, and tax authorities. Through detailed financial reporting and analysis, accounting services help business owners understand where their money is certainly going, how to improve profitability, and what strategies could be employed for growth.

One of many key functions of accounting and bookkeeping services is to make sure regulatory compliance. In several countries, businesses are required by law to keep up certain records and report their financial activities accurately. Failing to do this can result in penalties, fines, as well as legal consequences. By outsourcing these services to professionals who're well-versed in tax laws, financial reporting standards, and industry regulations, companies can avoid these pitfalls and focus on the core operations. Moreover, professional accounting services might help businesses prepare for audits, ensuring that their records have been in order and easily accessible.

Another significant benefit of accounting and bookkeeping services is the time and resources they save for business owners. Entrepreneurs and small company owners, in particular, often wear multiple hats, handling sets from marketing to operations. Keeping track of finances may be overwhelming and time-consuming. By entrusting their financial management to accounting and bookkeeping professionals, business owners can release valuable time to concentrate on growing their business, improving products and services, and building customer relationships. Moreover, professional accountants can offer expert advice on financial planning, budgeting, and investment opportunities, helping businesses maximize their profits.