A mortgage calculator is an invaluable software that assists potential homeowners determine their regular mortgage funds based on numerous factors. By inputting facts like the loan volume, fascination charge, loan term, and often house taxes or insurance premiums, the calculator may rapidly calculate what a borrower can get to pay for each month. This software is particularly helpful for first-time homebuyers who might not need a clear knowledge of how mortgage obligations are structured or what they could afford. By using a mortgage calculator, individuals may gain a better image of their economic obligations and greater program their budget accordingly.

The primary function of a mortgage calculator is always to assess the monthly payment. Including not just the key and interest but may also integrate extra fees like house fees, homeowners insurance, and even individual mortgage insurance (PMI) if the borrower places down significantly less than 20% of the home's value. These extra fees can significantly influence the sum total monthly payment, so it's very important to component them in when assessing affordability. Some sophisticated mortgage calculators even allow customers to account fully for homeowners association (HOA) fees, that may range with regards to the neighborhood.

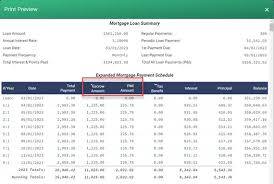

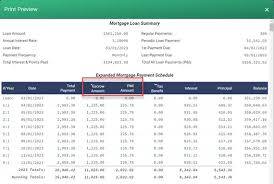

Knowledge how the monthly payment is damaged down is yet another essential advantageous asset of employing a mortgage calculator. In early decades of a loan, a larger percentage of the payment moves toward curiosity rather than principal. As time passes, nevertheless, the key portion raises since the loan stability decreases. A mortgage calculator often has an amortization routine, which reveals that description around living of the loan. This assists borrowers know the way significantly of these monthly cost is going toward lowering the loan stability, and simply how much is actually just spending the lender for the utilization of their money.

Among the main factors in determining mortgage obligations may be the fascination rate. The rate at that your loan is financed straight affects how much a borrower can pay around living of the loan. Small changes in interest rates might have a big effect on regular payments. As an example, a higher fascination rate raises the cost of borrowing, indicating larger monthly payments and more paid in curiosity around time. Alternatively, a lowered rate reduces the monthly payment and the entire price of the mortgage. Mortgage calculators allow users to experiment with various interest costs to see how improvements can influence their payments.

Mortgage calculators may also be ideal for comparing different loan options. Like, a borrower may want to assess the monthly cost on a 15-year loan versus a 30-year loan. The monthly

Mortgage Calculator

for a 15-year mortgage can usually be higher as a result of smaller repayment period, but the sum total fascination compensated around the life span of the loan will soon be lower. With a mortgage calculator, borrowers may mimic different circumstances and determine which loan term most useful meets their budget and long-term economic goals.

Along with supporting borrowers assess obligations, mortgage calculators may also function as an instrument for qualifying for a loan. Lenders often use particular requirements, like debt-to-income relation (DTI), to evaluate whether a borrower are able to afford a mortgage. A mortgage calculator provides an estimate of the borrower's DTI by factoring inside their money and regular debt obligations. By plugging in their revenue and other debts, users could see whether or not they meet the typical DTI demands for certain loan.

Another feature that lots of mortgage calculators include is the capacity to calculate simply how much a borrower are able to afford based on the ideal regular payment. This really is great for audience who have a set budget at heart but aren't sure simply how much home they could afford. By inputting a target monthly payment, the calculator can back-calculate the loan total they may qualify for, factoring in the estimated curiosity rate and loan term. Thus giving consumers an idea of the price selection they should be contemplating when buying a home.

Finally, mortgage calculators are not only for homebuyers—they are also useful for homeowners that are contemplating refinancing their present mortgage. A refinance mortgage calculator will help establish the impact of refinancing on monthly funds, fascination rates, and the full total loan term. It can also display whether refinancing will save you money in the long run or whether the costs of refinancing outweigh the benefits. With the capability to adjust loan terms and interest prices, homeowners can determine whether refinancing is really a financially noise decision centered on their recent

for a 15-year mortgage can usually be higher as a result of smaller repayment period, but the sum total fascination compensated around the life span of the loan will soon be lower. With a mortgage calculator, borrowers may mimic different circumstances and determine which loan term most useful meets their budget and long-term economic goals.

for a 15-year mortgage can usually be higher as a result of smaller repayment period, but the sum total fascination compensated around the life span of the loan will soon be lower. With a mortgage calculator, borrowers may mimic different circumstances and determine which loan term most useful meets their budget and long-term economic goals.