Navigating the world of timeshares can be overwhelming, especially when it comes to mortgage obligations. If you’re considering canceling your timeshare mortgage, this guide will help you understand the process and your options.

Timeshare mortgages are loans used to purchase a share in a vacation property. Buyers often find themselves tied to ongoing financial obligations, which can become burdensome over time.

Before taking any steps, carefully review your timeshare contract. Look for cancellation clauses, cooling-off periods, and any stipulations regarding your mortgage.

Reach out to your lender to discuss your options. Some lenders may offer solutions like loan modification or payment deferment, which could alleviate immediate financial pressure.

In some cases, you might be able to rescind your purchase within a specific timeframe, typically within a few days to weeks after signing the contract. Be sure to check your local laws for specific time limits.

Timeshare cancellation laws vary by state. Familiarize yourself with your state’s regulations, which may provide additional rights or protections.

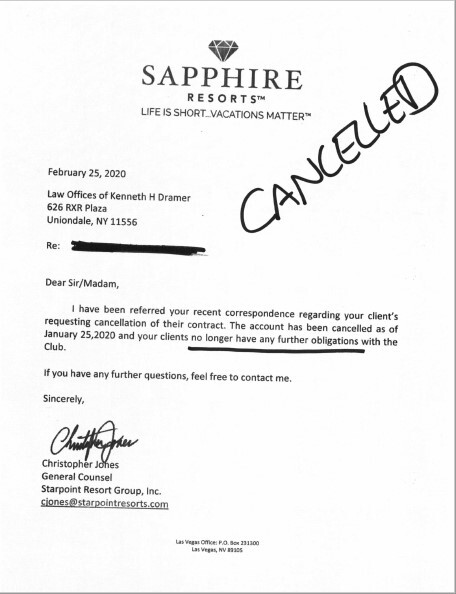

If you’re unsure about your rights, consider consulting with a lawyer who specializes in timeshare law. They can help you navigate the complexities of cancellation and ensure you’re making informed decisions.

If cancellation isn’t feasible, consider selling or renting your timeshare. While the market can be challenging, there are platforms dedicated to helping owners offload their timeshare properties.

Some companies specialize in helping owners exit their timeshare agreements. While these services can come with fees, they may provide a streamlined approach to cancellation.

Timeshare Mortgage Cancel can be a complex process, but with the right knowledge and resources, it’s possible to navigate your options successfully. Whether through cancellation, selling, or other alternatives, take the time to evaluate your situation and make the best choice for your financial future.